Today, I would like to post about JP Morgan Chase (JPM), the No. 1 banking industry. Currently, there is a lot of dividends received from January to April to July to October because mortgage-related stocks have high dividends. There are a large portion of them in IVR, and a small number of them in MFA and NYMT. Although it is anxious that the mortgage has a lot of dividends, I decided to hold the dividend because there is a point that if it recovers to the previous high, the dividend can be much higher here. However, as a hedge against this, we decided to hold a bank stock that hits the margin call (however, for psychological reasons, there is no guarantee that it will completely hedge).

Among the banking stocks, JPM and BAC, which are the first and second in the industry, are largely the number one bank in the industry that does not stop paying dividends even in Corona. However, given that the dividend rate is similar to the 2% range, there seems to be no reason to take it to the second place.

-About Company

JPMorgan Chase & Co. was founded in 1799 and is headquartered in New York, New York. JPMorgan Chase & Co. operates as a financial services company worldwide. It operates in 4 divisions. These include Consumer & Community Banking (CCB), Corporate & Investment Banking (CIB), Commercial Banking (CB), and Asset & Asset Management (AWM). The CCB sector provides consumers with deposit and investment products and services, loans to SMEs, deposit and cash management and payment solutions, mortgage and mortgage loans, credit cards, car loans and rental services. The CIB segment provides corporate strategy and structure advisory, capital and debt market capital raising services, loan initiation and syndication, wholesale payments and cross-border financing, cash securities and derivatives, risk management solutions, and investment banking products and services including Prime br. Research and research. The sector also provides securities lending products to asset managers, insurance companies, and public and private investment funds. The CB sector provides financial solutions including lending, investment banking and asset management to small and medium-sized businesses, large corporations, local government and non-profit clients, as well as commercial real estate banking services for a wide range of investors, developers, owners and offices, retail, industrial and residential. .Desecrate home property The AWM segment provides institutional clients and retail investors with multi-asset investment management solutions for stocks, fixed income, alternative and money market funds, retirement products and services, brokerage, storage, trust and real estate, loans, mortgage loans, deposit and investment management products. Provides. It also provides ATM, online and mobile, and telephone banking services.

JP Morgan Chase and Goldman Sachs were the top leading investment banks in the world in terms of generated revenues, with 8.9 and 7.5% percent of the market share respectively in 2019

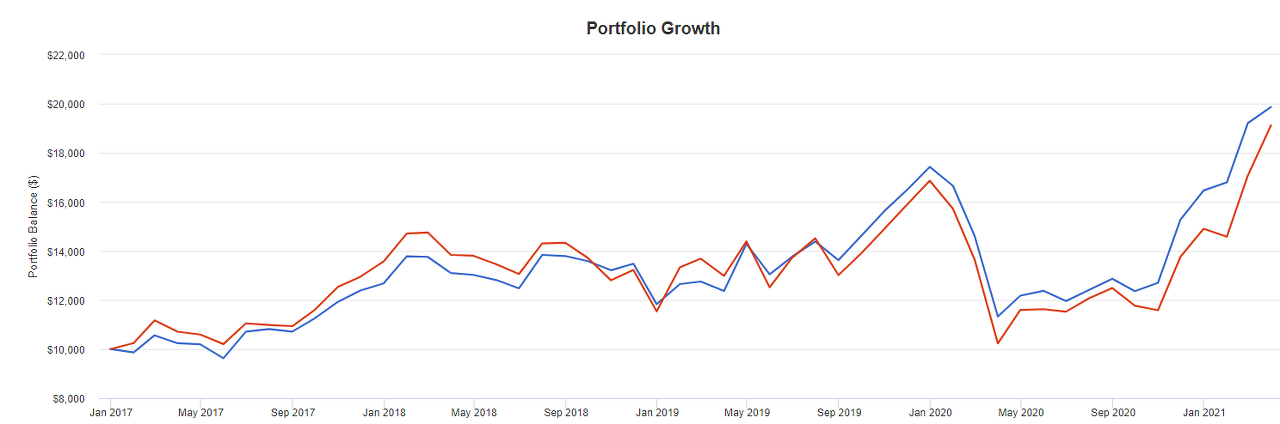

-Stock chart

In the past 5 years, it has recovered its full high since the coronavirus and has surpassed the market rate of return. I didn't know that the stock price would recover sooner than expected. If I knew it, I would have bought it.

The first and second place in the banking industry have a similar comparison for five years. Reports are being updated as interest rates have risen recently.

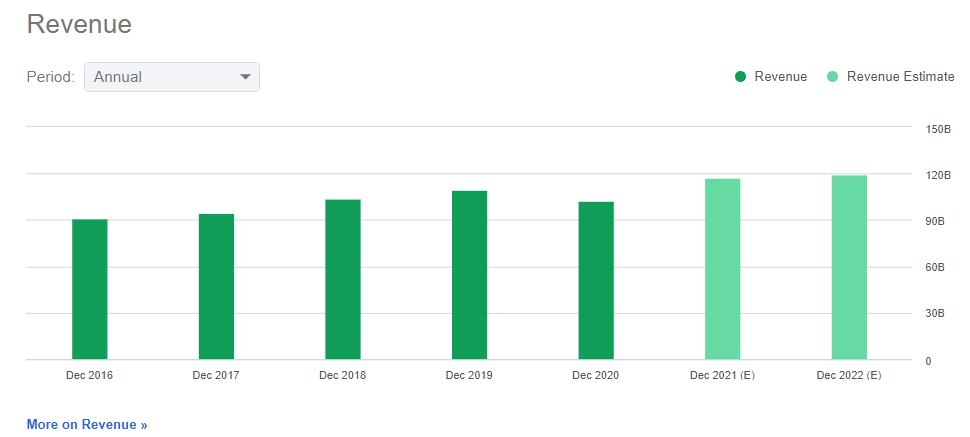

-Financial Statements

Market Cap: $468B

Dividend Rate: 2.3%

Net profit: 32.6 trillion

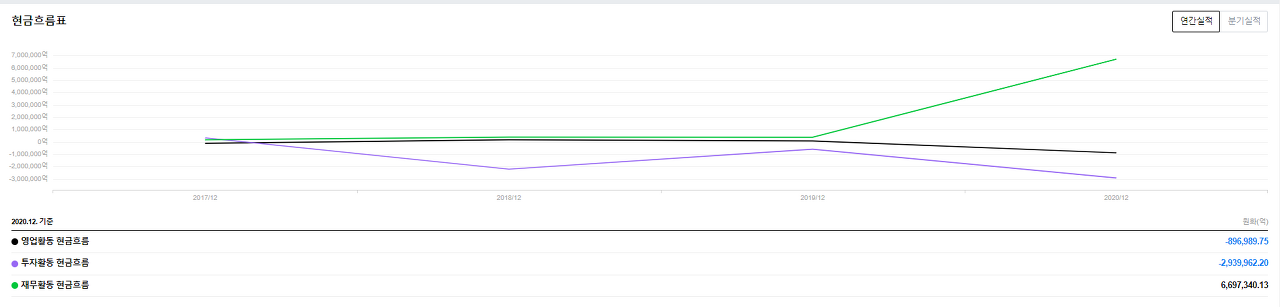

Bank stock is peculiar. Net profit is far more than operating profit.

It seems that it is because I earned income from interests on loans before that, rather than profits from business.

In this corona, even though it showed negative 89 trillion won, the net profit was 32 trillion.

He is the number one gangster banker in the industry who lives on loan interest.Net profit exceeded 30 trillion units despite the aftermath of the coronavirus.

If you look at the income statement, you can see that banks have increased their loans (loss provisions) to 11 trillion won.It seems that in order to overcome the corona pandemic crisis, a large amount of money was saved to prepare for the Lehman Brothers crisis in 2008.

Thanks to this, the crisis has passed well.

-Dividend details

Overall dividend review: JPMorgan Chase & Co. pays a dividend of $3.60 per share every year, and currently has a dividend yield of 2.32%. JPMorgan Chase & Co. does not yet have a streak of dividend growth. The odds for JPMorgan Chase & Co. are 34.35%. This payment rate is less than 75%, which is healthy and sustainable. JPMorgan Chase predicts that the dividend payout ratio will reach 36.77% next year based on earnings estimates. This means that JPMorgan Chase can continue or increase its dividend. Obviously, we can see the tendency to prioritize stability.

It is usually around 2%, and it has risen to the 4% level during the coronavirus. It is very regrettable that I did not know that I would recover so quickly, and I regret that I would have bought it if I had studied it. I will have to collect it little by little in the future.

-Conclusion

1. JPM, the No. 1 banking stock in the industry, has a very stable dividend payout ratio to net profit, so it can receive dividends in the long run.

2. Since the dividend growth rate is excellent, I believe that the current dividend rate will return in the 2% range and a good dividend rate will come back in the future. Let's collect it from now on.

'US stock' 카테고리의 다른 글

| Dividend Stock - Pepsi (PEP) 2nd in the beverage industry! (0) | 2021.05.01 |

|---|---|

| Dividend stock - Procter & Gamble (PG) No. 1 in the essential consumer industry! (0) | 2021.04.30 |

| Dividend Stock in July - Altria Group (MO) (1) | 2021.04.24 |

| Dividend Stock of April - American Tower (AMT) Real Estate Industry No. 1! (2) | 2021.04.24 |

| Dividend stock in July - Prologis (PLD) (0) | 2021.04.24 |

댓글